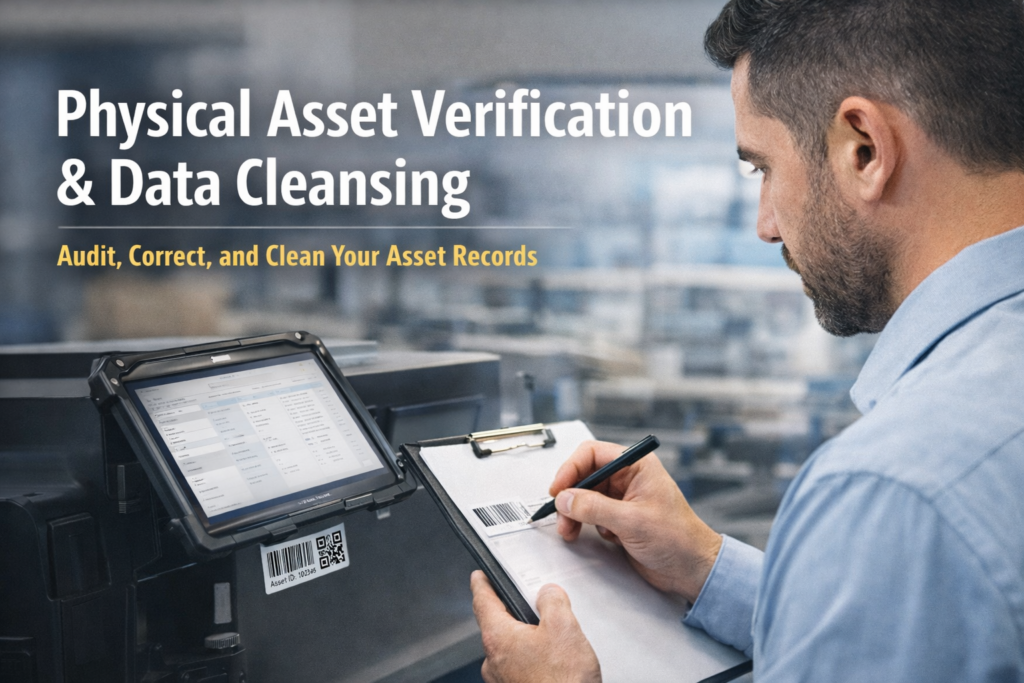

Close the Gaps.

Find the Missing Links.

Reconcile physical assets with financial and operational records to eliminate discrepancies, ensure compliance, and restore complete confidence in your asset data.

3-Way Reconciliation

Align physical assets, registers, and financial books with precision

Ghost Asset Detection

Identify non-existent entries and recommend accurate write-offs

Unrecorded Asset Discovery

Capture overlooked assets and unlock capitalization opportunities

Audit-Ready Documentation

Comprehensive records to support internal and external audits

Delivering comprehensive asset reconciliation services

We perform reconciliation between physical assets and existing financial or operational records, identifying unrecorded assets, duplicates, ghost assets, and misclassified entries. This helps organizations comply with audits, optimize insurance coverage, and align with accounting best practices.

From educational groups in Dubai to government directorates in Riyadh, our reconciliation service has supported fiscal responsibility, reduced compliance risk, and improved asset valuation.

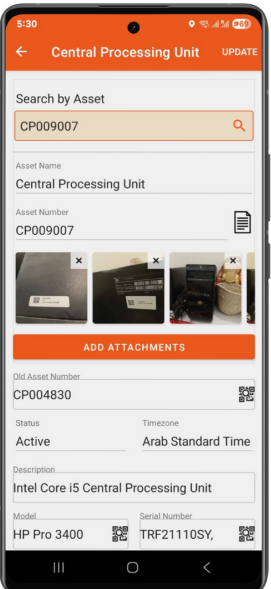

Aligning Records with Reality

Asset reconciliation is the process of comparing physical asset presence with accounting records and existing registers. The goal is to ensure data integrity, identify ghost or unrecorded assets, and align asset ownership, classification, and location across departments. This process improves audit transparency, ensures correct asset capitalization, and removes errors that impact insurance, depreciation, and financial planning.

3-Way Matching

We compare three data sources:

- Physical asset data collected onsite,

- Current asset register, and

- Financial fixed asset ledger.

Discrepancy Identification

- Missing Assets: Recorded but not found physically.

- Ghost Assets: Physically found but not in any register.

- Misclassified Assets: Wrong location, user, or department.

Exception Reporting

A detailed reconciliation report is produced showing additions, deletions, updates, and variances with root causes.

Final Alignment

Registers and ledgers are updated based on approved reconciliation results.

Reconciling your physical and financial asset records uncovers inconsistencies that impact compliance, planning, and profitability. Here’s how organizations transform through our reconciliation process

| Before Asset Register Reconciliation | After Asset Register Reconciliation |

|---|---|

| Inaccurate asset counts across departments | Verified, traceable inventory of all physical assets |

| Ghost assets still depreciating on financial books | Ghost assets removed, reducing unnecessary expenses |

| Unrecorded or newly purchased assets not capitalized | All active assets recorded, tagged, and capitalized |

| Duplicate or misclassified entries in the asset register | Cleaned and standardized asset data |

| Departmental confusion over asset ownership/location | Clear ownership and location history for every asset |

| Unreliable data for audits or insurance claims | Audit-ready registers and accurate insurance valuations. |

| Inconsistent values in ERP, CMMS, and finance systems | Synchronized data across all platforms |

Accurate, aligned, and actionable asset records that support better budgeting, stronger compliance, and smarter lifecycle planning.

Trusted by leading organizations, our asset reconciliation services combine accuracy, and complete asset documentation — giving you confidence that every asset is identified, traceable, and secure.

Transparent process flow with field logs and validation checks

Financial reconciliation aligned with audit/IFRS principles

Experience with 20,000+ reconciled assets per project

Delivering Excellence Across Saudi Arabia and UAE